UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant

Check the appropriate box:

☑ Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material under §240.14a-12

PHX MINERALS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

Fee paid previously with preliminary materials

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, of the Form or Schedule and the date of its filing.

Notice of Annual Meeting of Stockholders

To be held March 6, 2023May 16, 2024

To the Stockholders of PHX Minerals Inc.:

Notice is hereby given that the annual meeting of the stockholders (“Annual Meeting”) of PHX Minerals Inc. (the “Company”) will be held virtually, on Monday, March 6, 2023,Thursday, May 16, 2024, at 9:00 a.m. Central StandardDaylight Time. The virtual meeting can be accessed at www.proxydocs.com/PHX. At the Annual Meeting, we plan to ask you:

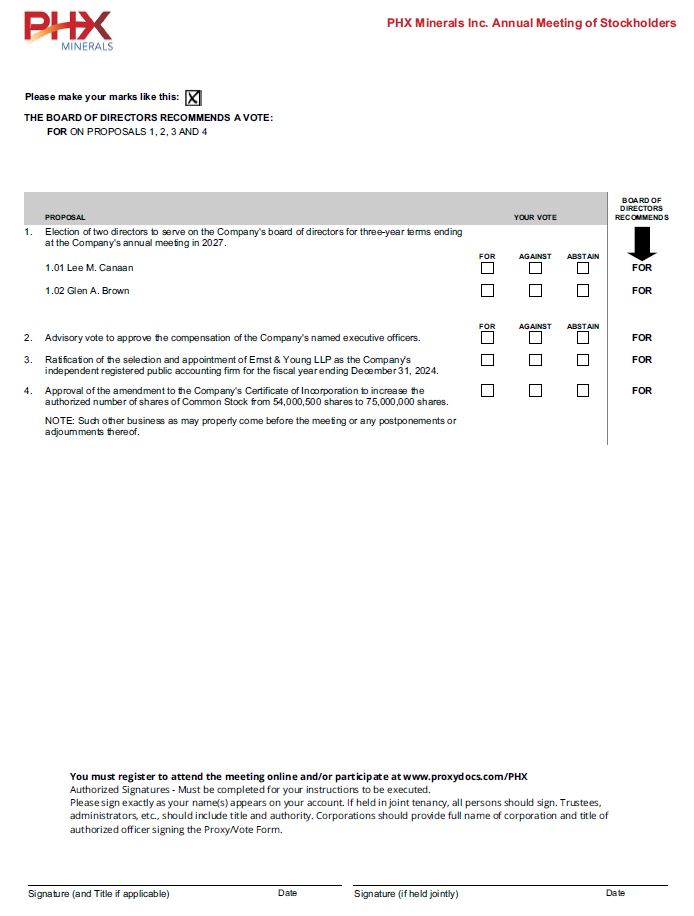

1. To elect the two director nominees named in the accompanying proxy statement to serve on the Company’s Board of Directors until the Company’s 20262027 annual meeting of stockholders or until their successors are duly elected and qualified;

2. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers;

3. To ratify the selection and appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;2024;

4. To approve an amendment to the PHX Minerals Inc. 2021 Long-Term Incentive Plan to increase the number of authorized shares by 2,400,000of common stock, par value $0.01666 per share, of the Company (“Common Stock”) from 54,000,500 shares to 75,000,000 shares; and

5. To consider and act upon any other matter as may properly come before the meeting or any adjournment or postponement thereof.

We have set the close of business on January 9, 2023March 28, 2024 as the record date for the Annual Meeting and only holders of record of the Company’s common stockCommon Stock at such date will be entitled to vote at the Annual Meeting and any adjournments or postponements thereof. The Annual Meeting will be held in a virtual-only meeting format, via live video webcast, that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. We have implemented a virtual-only meeting format in order to leverage technology to enhance stockholder access to the Annual Meeting by enabling attendance and participation from any location around the world. We believe that the virtual-only meeting format will give stockholders the opportunity to exercise the same rights as if they had attended an in-person meeting and believe that these measures enhance stockholder access and encourage participation and communication with our Board of Directors and management. Please note that you will only be able to attend the Annual Meeting by means of remote communication – you will not be able to attend the Annual Meeting if you do not have Internet access. There will not be a physical meeting location. You or your proxyholder will be able to attend the Annual Meeting online, examine a list of our stockholders of record, and submit your questions and vote your shares electronically by visiting www.proxydocs.com/PHX. To be admitted to the Annual Meeting and vote your shares, you must register and provide the Control Number as described in the Notice of Internet Availability of Proxy Materials and proxy card. We have designed the

format of the Annual Meeting to ensure that you are afforded the same rights and opportunities to participate as you would have at an in-person meeting.

The Annual Meeting webcast will begin promptly at 9:00 a.m. Central StandardDaylight Time, on March 6, 2023.May 16, 2024. Online access to the virtual meeting website will begin at 8:45 a.m. Central StandardDaylight Time, and we encourage you to access the Annual Meeting prior to the start time.

Pursuant to rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) instead of a paper copy of thisthe accompanying proxy statement, a proxy card and our 20222023 annual report. The Notice contains instructions on how to access those documents over the Internet, as well as instructions on how to vote. All stockholders who do not receive a Notice should receive a paper copy of the proxy materials by mail. We believe that the Notice process allows us to provide our stockholders with information in a timelier manner, reduces our printing and mailing costs, and helps to conserve resources. The Company anticipatesWe anticipate the Notice will be mailed to stockholders on or about January 23, 2023.April 5, 2024.

Whether you plan to attend the Annual Meeting or not, we encourage you to vote by following the instructions on the Notice or, if you received a paper copy of the proxy card, by signing and returning it in the postage-paid envelope. Voting by proxy will ensure your shares are represented at the Annual Meeting. Please review the instructions on the Notice or the information forwarded by your bank, broker or other holder of record regarding each of these voting options.

We thank you for your continued support and look forward to seeing you at the Annual Meeting.

By Order of the Board of Directors |

|

|

Fort Worth, Texas

January 23, 2023April 5, 2024

YOUR VOTE IS IMPORTANT.IMPORTANT

YOUR VOTE IS IMPORTANT, AND WE ENCOURAGE YOU TO VOTE EVEN IF YOU ARE UNABLE TO ATTEND THE ANNUAL MEETING. YOU MAY VOTE BY INTERNET OR TELEPHONE USING THE INSTRUCTIONS ON THE NOTICE, OR BY MARKING, SIGNING AND DATING THE ENCLOSED PROXY AND MAILING IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED IF YOU RECEIVED A PAPER COPY OF THE PROXY CARD.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on March 6, 2023. ThisMay 16, 2024. The proxy statement, form of proxy card and the Company’s 20222023 Annual Report to Stockholders are available at the following website: www.proxydocs.com/PHX or by writing to the Company at the address above. The Annual Report contains the financial documentsstatements of the Company.

Table of Contents

Page | |

| |

1 | |

2 | |

9 | |

9 | |

Directors Nominated for |

|

| |

| |

Board Leadership Structure and Non-Executive Chairman of the Board |

|

13 | |

13 | |

| |

| |

16 | |

Director Compensation for | 17 |

18 | |

18 | |

19 | |

19 | |

19 | |

20 | |

| |

| |

| |

22 | |

23 | |

24 | |

24 | |

| |

| |

Elements of |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proposal No. 4 – Approval of Amendment to the |

|

| |

| |

| |

| |

| |

| |

42 | |

42 | |

42 | |

42 | |

| 43 |

(i)

43 | |

| 43 |

| |

| |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

(i)

| |

| |

|

|

A-1 | |

(ii)

(ii)

Proxy Statement Summary

This summary is included to provide an introduction and overview of the information contained in this Proxy Statement. This summary does not contain all of the information you should consider, and you should carefully read the Proxy Statement in its entirety before voting. Additional information regarding the Company and its performance in fiscal year 20222023 and the Transition Period can be found in our Annual Report on Form 10-K for the year ended December 31, 2023.

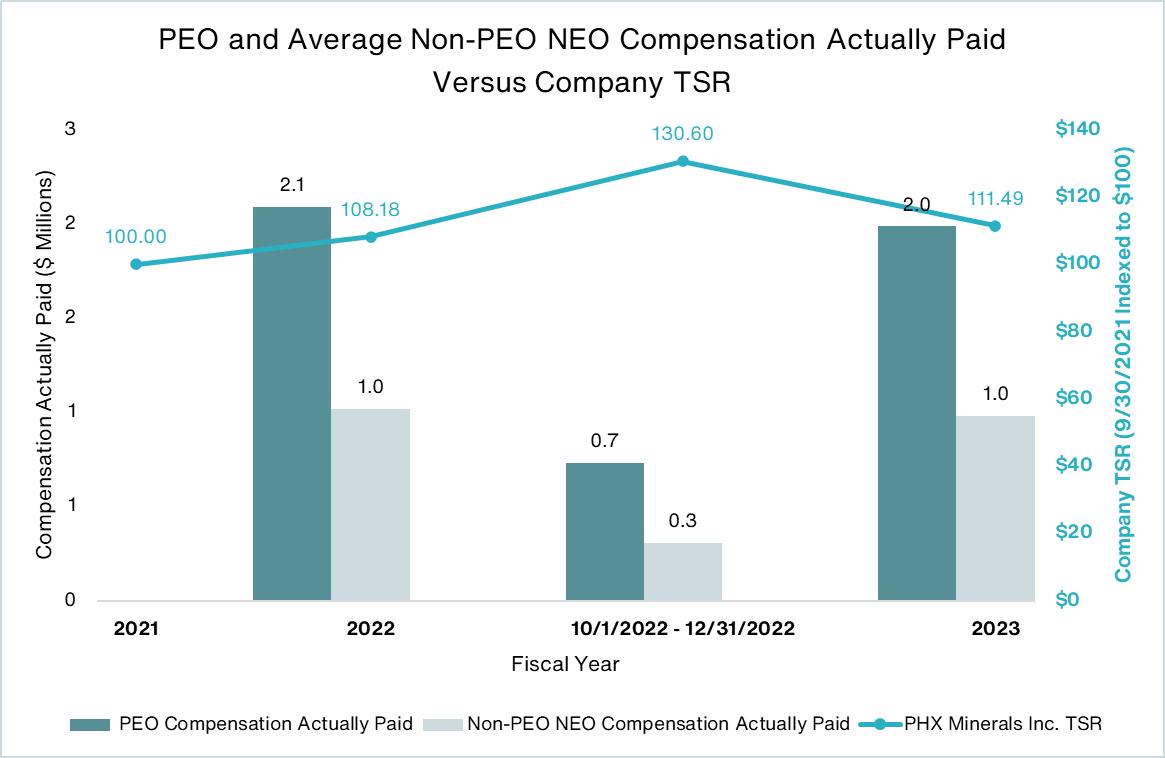

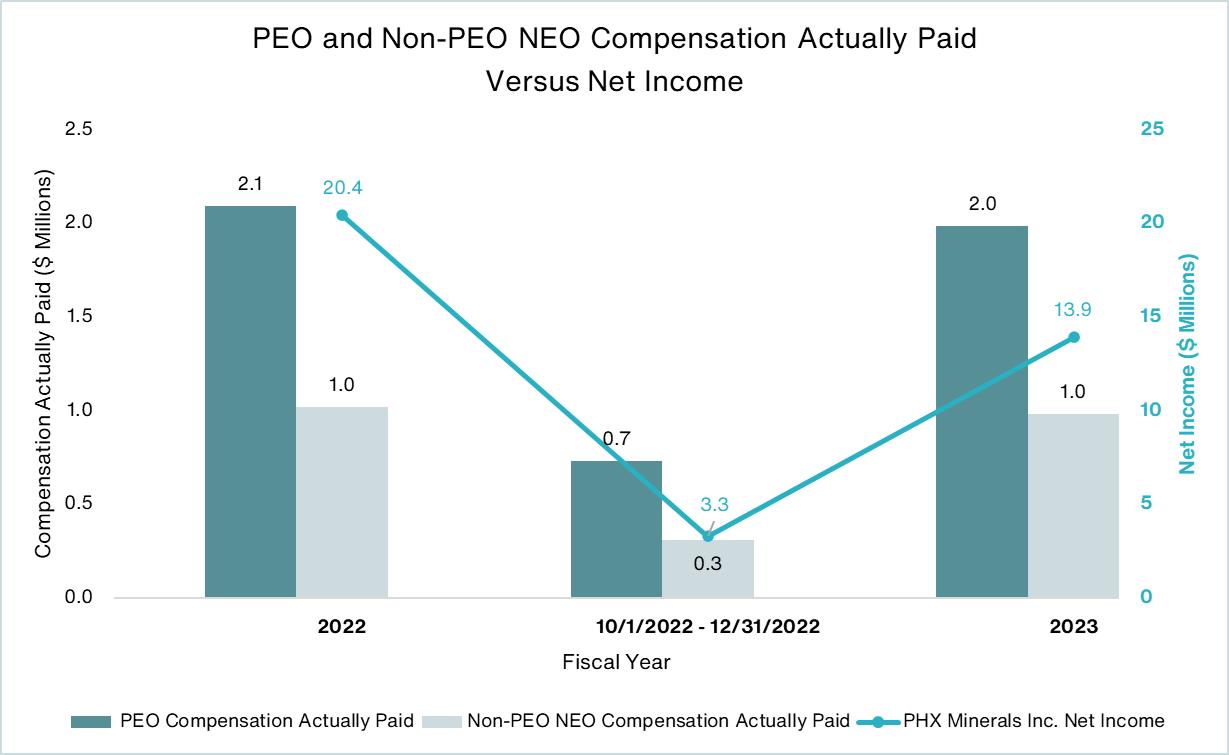

Transition to Calendar Year for Fiscal Year 2023

As previously announced, the Company transitioned to a calendar year fiscal year beginning January 1, 2023 to be in-line with our peer group. In this Proxy Statement, all references to years or fiscal years, unless otherwise noted, refer to the Company’s fiscal year ended December 31 with respect to 2023 and the Company’s fiscal year ended September 30 with respect to prior years. For example, references to 2023 mean the year ended December 31, 2023 and references to 2022 mean the year ended September 30, 2022. We refer to the period from October 1, 2022 to December 31, 2022 as the “Transition Period” or “Tr.”. References to “calendar” or “calendar year” refer to the year ended December 31, regardless of the fiscal year end for such year.

| |

Date and Time: |

|

Location: | Virtual access at www.proxydocs.com/PHX |

Record Date: |

|

Stockholders Entitled to Vote: | Holders of our Common Stock, par value $0.01666 per share (“Common Stock”), as of the close of business on the Record Date are entitled to vote. Each share of Common Stock is entitled to one vote by proxy or in person at the Annual Meeting. |

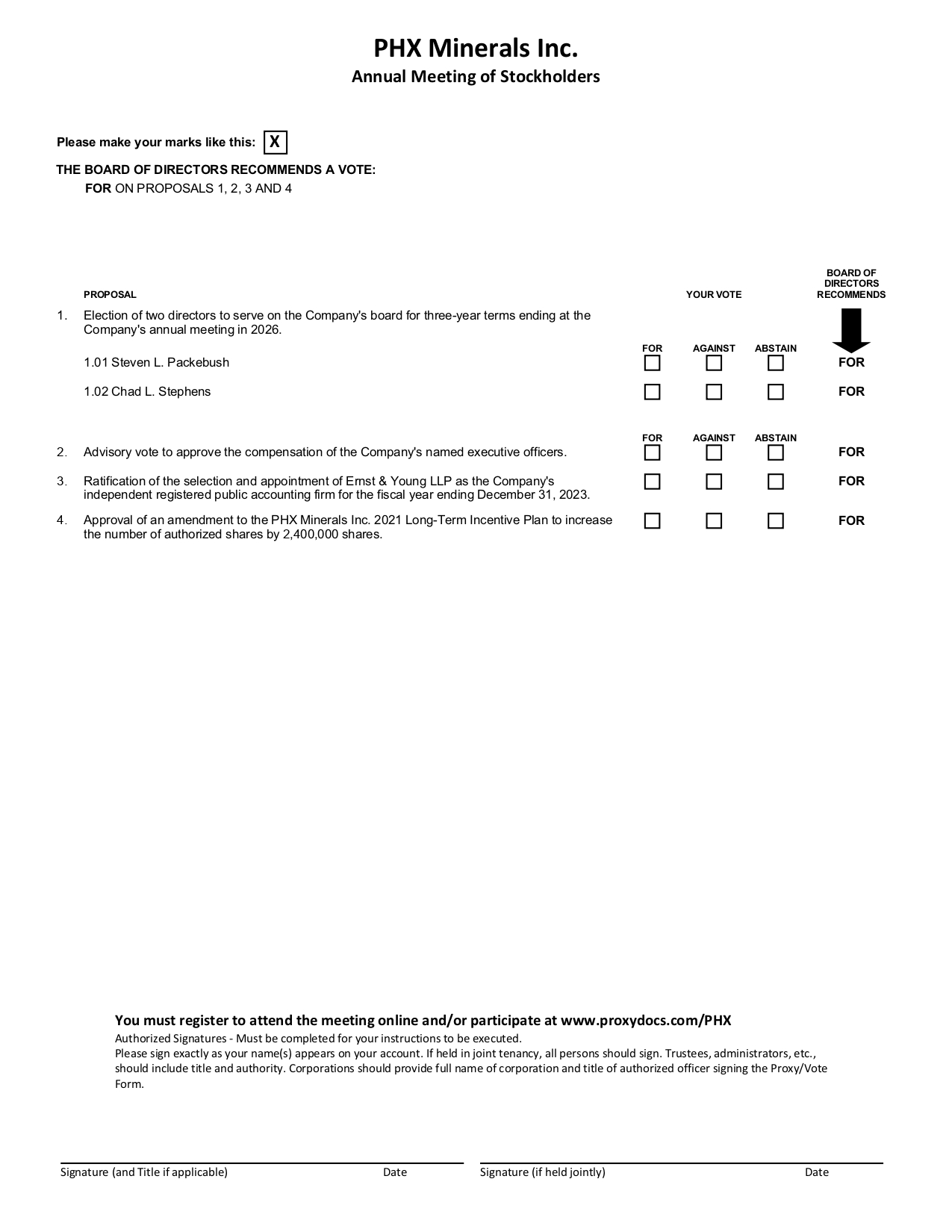

PROPOSALS AND BOARD RECOMMENDATIONS |

|

| ||

Proposal | Board | |||

No. 1 | Election of two directors to serve on the Company’s board of directors for three-year terms ending at the Company’s annual meeting in | FOR | ||

No. 2 | Advisory vote to approve the compensation of the Company’s named executive officers. | FOR | ||

No. 3 |

| Ratification of the selection and appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, |

| FOR |

No. 4 |

| Approval of |

| FOR |

(1)

QUESTIONS AND ANSWERS ABOUT

THE ANNUAL MEETING AND VOTING

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting, including (1) the election of two director nominees to serve on our board of directors (the “Board”) for three-year terms ending at the annual meeting of stockholders in 20262027 (this proposal is referred to as the “Election of Directors”); (2) a non-binding, advisory vote to approve the compensation of our named executive officers (this proposal is referred to as “Executive Compensation”); (3) the ratification of the selection and appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20232024 (this proposal is referred to as “Ratification of Accounting Firm”); (4) the approval of an amendment to the PHX Minerals Inc. 2021 Long-Term Incentive PlanCompany’s Certificate of Incorporation to increase the number of authorized shares by 2,400,000of Common Stock from 54,000,500 shares to 75,000,000 shares (this proposal is referred to as “LTIP Amendment”“Amendment to Certificate of Incorporation to Increase Authorized Shares”); and (5) the transaction of such other business as may arise that can properly be conducted at the Annual Meeting or any adjournment or postponement thereof.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate a person or entity as your proxy in a written document, such document is also called a proxy or a proxy card. All duly executed proxies received prior to the Annual Meeting will be voted in accordance with the choices specified thereon and, in connection with any other business that may properly come before the meeting,Annual Meeting or any adjournment or postponement of the Annual Meeting, in the discretion of the persons named in the proxy.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we make available to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting. This proxy statement describes matters on which we would like you, as a stockholder, to vote and provides you with information on such matters so that you can make an informed decision.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of printed proxy materials?

Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the costs and environmental impact of the Annual Meeting.

How can I access the proxy materials over the Internet?

Pursuant to rules adopted by the SEC, we provide stockholders access to our proxy materials for the Annual Meeting over the Internet. The proxy materials for the meeting are available at www.proxydocs.com/PHX. To access these materials and to vote, follow the instructions shown on the proxy card, voting instruction card from your broker or the Notice.

Can I get paper copies of the proxy materials?

You may request paper copies of the proxy materials, including our 20222023 annual report, by calling 1-866-648-8133 or e-mailing paper@investorelections.com with “Proxy Materials PHX Minerals Inc.” in the subject line. Include your full name and address, plus the control number located in the shaded bar on the reverse side of the Notice

(2)

Notice received and state that you want a paper copy of the Annual Meeting materials. You also may request paper copies when prompted at www.investorelections.com/PHX.

Can I choose the method in which I receive future proxy materials?

Below are descriptions of the methods in which stockholders of record may receive future proxy materials or notice thereof:

Notice and Access: The Company furnishes proxy materials over the Internet and mails the Notice to most stockholders.

Mail: You may request distribution of paper copies of future proxy materials by mail by calling 1-866-648-8133, or by e-mailing paper@investorelections.com with “Proxy Materials PHX Minerals Inc.” in the subject line. Include your full name and address, plus the control number located in the shaded bar on the reverse side of the Notice received and state that you want a paper copy of the Annual Meeting materials. If you are voting electronically at www.proxypush.com/PHX, follow the instructions to enroll for paper copies by mail after you vote.

E-mail: If you would like to have earlier access to future proxy materials and reduce our costs of printing and delivering the proxy materials, you can instruct us to send all future proxy materials to you via e-mail. If you request future proxy materials via e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials via e-mail will remain in effect until you change it. If you wish to receive all future materials electronically, please log in to www.investorelections.com/PHX to enroll or, if voting electronically at www.investorelections.com/PHX, follow the instructions to enroll for electronic delivery.

If you are a beneficial owner rather than a stockholder of record, you should consult the directions provided by your broker, bank, or other nominee with respect to how you receive your proxy materials and how to vote your shares.

Can I vote my shares by completing and returning the Notice?

No, the Notice simply instructs you on how to vote. You may vote by Internet or telephone using the instructions on the Notice, or by marking, signing and dating the enclosed proxy card and mailing it promptly in the postage-paid envelope, provided you received a paper copy of the proxy card.

What is “householding”?

The SEC permits companies and intermediaries (such as brokers, banks and other nominees) to satisfy delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report to those stockholders. This practice,procedure, known as “householding,” is designed to reduce duplicate mailings and save significant printing and postage costs. If you received a householded mailing this year under the “householding” procedure and you would like to have additional copies of our Notice or paper copies of our proxy statement, proxy card and annual report (the “Proxy Materials”) mailed to you or you would like to opt out of this practiceprocedure for future mailings, please submit your request in writing to Computershare, P.O. Box 43078, Providence, RI 02940-3078, or by telephone by calling 1-800-884-4225, and we will promptly deliver such additional materials to you. You may also contact us in the same manner if you received multiple copies of the Proxy Materials and would prefer to receive a single copy in the future. The Proxy Materials are also available at: www.proxydocs.com/PHX.PHX.

(3)

What should I do if I receive more than one set of voting materials?

Despite our efforts related to householding, you may receive more than one copy of the Notice and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a proxy card and a voting instruction card. Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted at the Annual Meeting.

Who is entitled to notice of, and to vote at, the Annual Meeting?

Governing laws and our governance documents require our Board to establish a record date in order to determine who is entitled to receive notice of, attend and vote at the Annual Meeting, and any continuations, adjournments or postponements thereof.

The record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on January 9, 2023March 28, 2024 (the “Record Date”).

As of the Record Date, we had 36,491,33337,458,487 shares of Common Stock outstanding. All holders of Common Stock of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting or any adjournments or postponements.

A list of all stockholders of record entitled to vote at our Annual Meeting will be available for examination at least 10 days prior to the Annual Meeting at our office located at 1320 S. University Dr., Suite 720, Fort Worth, TX 76107, during normal business hours, and will be available for inspection at the Annual Meeting.

How do I attend and participate in the Annual Meeting?

Attendance at the Annual Meeting is limited to stockholders as of the Record Date. Stockholders can register to attend the Annual Meeting by visiting www.proxydocs.com/PHX. The Annual Meeting will begin promptly at 9:00 a.m. Central StandardDaylight Time. We encourage you to allow ample time for online check-in, which will open at 8:45 a.m. Central StandardDaylight Time. If you plan to participate, submit questions or vote during the virtual Annual Meeting, you will need the Control Number included in the Notice or proxy card.

How can I request technical assistance during the Annual Meeting?

If you encounter any difficulties accessing the Annual Meeting during the check-in or during the meeting, please call the technical support number that will be posted on the virtual meeting log-in page at www.proxydocs.com/PHX.

Will I be able to ask questions during the Annual Meeting?

Stockholders will be able to transmit questions through www.proxydocs.com/PHX. Only stockholders with a valid Control Number will be allowed to ask questions. Questions pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints.

What is a quorum?

A quorum is the presence, in person or by proxy, of a majority of the shares of our Common Stock outstanding and entitled to vote as of the Record Date. There must be a quorum for the transaction of business at the Annual Meeting. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is reached. Proxies received but marked as abstentions or broker non-votes will be included in the calculation of votes considered to be present at the Annual Meeting for the purpose of determining a quorum.

(4)

What are the voting rights of our stockholders?

(4)

Each record holder of Common Stock is entitled to one vote per share of Common Stock on all matters to be acted upon at the Annual Meeting.

What is the difference between a stockholder of record and a “street name” holder?

Most stockholders hold their shares in “street name” through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name.

| | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly or to vote in person at the Annual Meeting. |

| Street Name Stockholder. If your shares are held in a stock brokerage account or by a bank, fiduciary or other nominee, you are considered the beneficial owner of shares held in “street name.” In this case, such broker, bank or other nominee is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote and are also invited to attend the Annual Meeting. If you hold your shares in “street name,” follow the voting instructions provided by your broker, bank or other nominee to vote your shares. Since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder (your bank, broker or other nominee) giving you the right to vote the shares. |

How do I vote my shares?

Stockholders of Record: Stockholders of record may vote their shares or submit a proxy to have their shares voted by one of the following methods:

| | By Proxy. You may give us your proxy by calling the toll-free telephone number or using the Internet as further described on the Notice. Telephone and Internet voting procedures have been designed to verify your identity through a personal identification or control number and to confirm that your voting instructions have been properly recorded. If you received a paper proxy card, you may give us your proxy by completing the proxy card and returning it to us in the U.S. postage-prepaid envelope accompanying the proxy card. |

| | To Vote During the Annual Meeting. You must do so through www.proxydocs.com/PHX. To be admitted to the Annual Meeting and vote your shares, you must register and provide the Control Number as described in the Notice and proxy card. After completion of your registration, further instructions, including a unique link to access the Annual Meeting, will be emailed to you. |

Street Name Stockholders: Street name stockholders may vote their shares or direct their broker, bank or other nominee to vote their shares by one of the following methods:

| | By Voting Instruction Card. If you hold your shares in street name, your broker, bank or other nominee will explain how you can access a voting instruction card for you to use in directing the broker, bank or other nominee how to vote your shares. The availability of telephone or Internet voting depends on the voting process used by the broker or nominee that holds your shares. |

| | To Vote During the Annual Meeting with a Proxy from the Record Holder. You may vote during the Annual Meeting if you obtain a legal proxy from your broker, bank or other nominee. Please consult the instruction card or other information sent to you by your broker, bank or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting. |

(5)

If you are a stockholder of record, your shares will be voted by the management proxy holder in accordance with the instructions on the proxy card you submit.

(5)

Can I revoke my proxy or change my vote?

Yes. If you are a stockholder of record, you can revoke your proxy at any time before it is voted at the Annual Meeting by doing one of the following:

| | submitting written notice of revocation stating that you would like to revoke your proxy to PHX Minerals Inc., Attention: |

| | using the same method (by telephone, Internet or mail) that you first used to vote your shares, in which case the later submitted proxy will be recorded and the earlier proxy revoked; or |

| | during the Annual Meeting, notifying the inspector of election that you wish to revoke your proxy and voting your shares during the Annual Meeting. Attendance at the Annual Meeting without submitting a ballot to vote your shares will not revoke or change your vote. |

If you are a beneficial owner or street name stockholder, you should follow the directions provided by your broker, bank or other nominee to revoke your voting instructions or otherwise change your vote before the applicable deadline. You may also vote during the Annual Meeting if you obtain a legal proxy from your broker, bank or other nominee as described in “How do I vote my shares?” above.

What are abstentions and broker non-votes?

An abstention occurs when the beneficial owner of shares, or a broker, bank or other nominee holding shares for a beneficial owner, is present, in person or by proxy, and entitled to vote at the Annual Meeting but fails to vote or voluntarily withholds its vote for any of the matters upon which the stockholders are voting.

Broker “non-votes” are shares held by brokers, banks or other nominees over which the broker, bank or other nominee lacks discretionary power to vote (such as for the election of directors) and for which the broker or nominee has not received specific voting instructions from the beneficial owner. If you are a beneficial owner and hold your shares in “street name,” you will receive instructions from your broker, bank or other nominee describing how to vote your shares. If you do not instruct your broker or nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange (NYSE). There are non-discretionary matters for which brokers, banks and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. If a broker, bank or other nominee does not have discretion to vote on a particular matter and you have not given timely instructions on how the broker, banker or other nominee should vote your shares, then such broker, bank or other nominee indicates it does not have authority to vote such shares on its proxy and a “broker non-vote” results. Although broker non-votes will be counted as present at the Annual Meeting for purposes of determining a quorum, they are not entitled to vote with respect to non-discretionary matters.

If your shares are held in street name and you do not give voting instructions, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of Directors), and Proposal 2 (Executive Compensation) and Proposal 4 (LTIP Amendment), and your shares will be considered broker non-votes with respect to these proposals. If your shares are held in street name and you do not give voting instructions, the record holder will have discretionary authority to vote your shares with respect to Proposal 3 (Ratification of Accounting Firm) and Proposal 4 (Amendment to Certificate of Incorporation to Increase Authorized Shares).

(6)

What vote is required for the proposals to be approved?

| | Proposal 1 (Election of Directors): To be elected, for an uncontested election, each nominee for election as a director must receive the affirmative vote of a majority of the votes cast by the holders of our Common Stock at the Annual Meeting. Votes may be cast “FOR” or “AGAINST” the |

(6)

election of each nominee. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

| | Proposal 2 (Executive Compensation): To consider and vote upon, on a non-binding, advisory basis, a resolution to approve the compensation of our named executive officers as disclosed pursuant to the compensation disclosure rules of the SEC. This non-binding advisory vote will be approved if it receives the affirmative vote of a majority of the shares of our Common Stock represented in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will have the effect of a vote “AGAINST” approval. |

| | Proposal 3 (Ratification of Accounting Firm): Ratification of the selection and appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| | Proposal 4 |

How does the Board recommend that I vote?

Our Board recommends a vote:

| | FOR each of the nominees for director; |

| | FOR the non-binding, advisory approval of named executive officer compensation; |

| | FOR the ratification of the selection and appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| | FOR the approval of |

What happens if I provide my signed proxy but do not specify how I want my shares to be voted, or if additional proposals are presented at the Annual Meeting?

If you provide us your signed proxy but do not specify how to vote, we will vote your shares as follows:

Proposal 1. FOR the election of each director nominee;

Proposal 2. FOR the approval, on an advisory basis, of the compensation of our named executive officers;

Proposal 3. FOR the ratification of the selection and appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and2024;

(7)

And

Proposal 4. FOR the approval of thean amendment to the PHX Minerals Inc 2021 Long-Term Incentive PlanCompany’s Certificate of Incorporation to increase the number of authorized shares by 2,400,000 shares.of Common Stock from 54,000,500 to 75,000,000.

(7)

Management knows of no other matters to be brought before the Annual Meeting. However, if any other matters do properly come before the meeting, it is intended that the shares represented by the proxies in the accompanying form will be voted as the Board may recommend.

Who will bear the cost of soliciting votes for the Annual Meeting?

The cost of soliciting proxies for the Annual Meeting will be paid by the Company. In addition to solicitation by mail, arrangements may be made with brokerage firms, banks or other nominees to send Proxy Materials to beneficial owners. The Company will reimburse these institutions for their reasonable costs in forwarding solicitation materials to such beneficial owners. The Company may engage third-party solicitors to solicit proxies for the Annual Meeting.

May I propose actions for consideration at the 20242025 annual meeting of stockholders or nominate individuals to serve as directors?

You may submit proposals for consideration at future stockholder meetings, including director nominations. Please read the “Stockholder Proposals” section of this proxy statement for information regarding the submission of stockholder proposals and director nominations for consideration at the Company’s 20242025 annual meeting of stockholders.

(8)

Proposal No. 1

Election of Two Directors for Three-Year Terms Ending at the Annual Meeting in 20262027

Directors

The current directors of the Company and their current Board Committee memberships are as follows:

|

|

|

| Positions/Offices Presently |

| Served As |

| Present | Positions/Offices Presently | Served As | Present | |||||

Name |

| Age |

| Held with the Company |

| Director Since |

| Term Ends | Age | Held with the Company | Director Since | Term Ends | ||||

Mark T. Behrman (1)(2) |

| 60 |

| Director, Non-Executive Chairman of the Board |

| 2017 |

| 2025 | 61 | Director, Non-Executive Chairman of the Board | 2017 | 2025 | ||||

Glen A. Brown (1)(2) |

| 66 |

| Director |

| 2021 |

| 2024 |

| 67 |

| Director |

| 2021 |

| 2024 |

Lee M. Canaan (1)(3) |

| 66 |

| Director |

| 2015 |

| 2024 | 67 | Director | 2015 | 2024 | ||||

Peter B. Delaney |

| 69 |

| Director |

| 2018 |

| 2024 | 70 | Director | 2018 | 2024 | ||||

Steven L. Packebush |

| 57 |

| Director |

| 2022 |

| 2023 | 59 | Director | 2022 | 2026 | ||||

John H. Pinkerton (2)(3) |

| 68 |

| Director |

| 2021 |

| 2025 | 70 | Director | 2021 | 2025 | ||||

Chad L. Stephens |

| 67 |

| Director, Chief Executive Officer |

| 2017 |

| 2023 | 68 | Director, Chief Executive Officer | 2017 | 2026 |

Our Bylaws state that the Board shall be comprised of not less than five members with the exact number of members to be determined by resolution of the Board adopted by a vote of two-thirds (2/3) of the Board or at an annual or special meeting of the stockholders by the affirmative vote of sixty-six and two-thirds percent (66-2/3%) of the shares of outstanding Common Stock entitled to vote. ThePeter B. Delaney’s current term as a director expires at the Annual Meeting, and he has informed the Board has setthat he is retiring from the currentBoard and will not stand for re-election at the Annual Meeting. After careful consideration, the Governance and Sustainability Committee and the Board as a whole have determined not to nominate a replacement for Mr. Delaney and instead to reduce the size of the Board atfrom seven members. members to six. As a result, the size of the Board will be six members following the Annual Meeting.

The Board is divided into three classes. At each annual stockholders’ meeting, the term of one class expires. Directors in each class ordinarily serve three-year terms, or until the director’s retirement or until his or her successor is elected and qualified.

The Board believes it is in the Company’s best interest to continue to have a classified board structure, with three-year terms for its directors, due to the uniqueness of the Company’s assets and strategies. The Company’s focus on ownership of perpetual fee mineral acres requires business strategies that are more long-term oriented as compared to more traditional oil and gas exploration and production companies. We believe that this requires the Company’s directors to have a long-term outlook and understanding rather than a focus on short-term results. ThisWe believe this focus on long-term results will serve the Company well and create value for our stockholders.

Based on the recommendations from the Governance and Sustainability Committee, ourthe Board has nominated two continuing directors, Chad L. StephensGlen A. Brown and Steven L. Packebush,Lee M. Canaan, to stand for election to the Board at the Annual Meeting, each to serve a three-year term expiring at the 20262027 annual meeting or until the election and qualification of their respective successors or until their earlier death, retirement, resignation or removal.

Mr. StephensBrown and Mr. PackebushMs. Canaan were recommended as nominees for election by the Governance and Sustainability Committee and approved by the Board. Each nominee has consented to being named as a nominee in this proxy statement and has indicated a willingness to serve on the Board if elected. However, if any nominee should be unable for any reason to accept nomination or election, it is the intention of the persons named in the proxy to vote such proxies for the election of such other person or persons as the Board may recommend.

(9)

Directors Nominated for Election at the Annual Meeting

Below is information about our nominees for election to the Board for three-year terms ending at the Company’s annual meeting in 2026.2027. The biographical information reflects the particular experience, qualifications, attributes and skills that led the Board to conclude that each nominee should stand for election to the Board.

Steven L. Packebush, 57, is a founder and partner in Elevar Partners, LLC, a company providing advisory services and capital solutions for companies in the agriculture and energy markets. Prior to Elevar Partners, Mr. Packebush worked at Koch Industries, Inc. for over 30 years, retiring in March 2018. Until his retirement, he was

(9)

the president of Koch Ag & Energy Solutions (“KAES”). Under his leadership, KAES grew to be one of world’s largest fertilizer companies. Mr. Packebush also oversaw the expansion of KAES, which included the addition of three start-up businesses: Koch Energy Services became one of the largest natural gas marketing companies in North America; Koch Methanol supplied methanol to global customers in the plywood, carpet, fuels, and plastics markets; and Koch Agronomic Services became a global leader in enhanced-efficiency fertilizer production and marketing. Mr. Packebush currently serves on the LSB Industries, Inc. board of directors. He is a graduate of Kansas State University with a bachelor’s degree in agricultural economics. Mr. Packebush was appointed to the Board effective April 2022.

Mr. Packebush’s qualifications to serve on the Board include his extensive management and operational experience, and his management of a natural gas marketing company, which provided him with a broad knowledge of the energy market.

Chad L. Stephens, 67, was appointed Chief Executive Officer of the Company on January 16, 2020. Prior to his appointment as Chief Executive Officer, Mr. Stephens served as the Interim Chief Executive Officer of the Company, a position he was appointed to in August 2019. Mr. Stephens previously served as Senior Vice President – Corporate Development of Range Resources Corporation (“Range”), a position he held from 2002 until his retirement effective December 31, 2018. Mr. Stephens joined Range in 1990 as Senior Vice President – Southwest. While at Range, he was responsible for the origination, valuation and acquisition or divestiture of over $6.0 billion of oil and gas producing properties. Mr. Stephens served on Range’s internal hedging committee and was responsible for the oversight of all gas, oil and NGL marketing and sales. Mr. Stephens holds a Bachelor of Arts degree in Finance and Land Management from the University of Texas. He was appointed to the Board in 2017 and previously served as its Lead Independent Director.

Mr. Stephens’ qualifications to serve on the Board include his 40 years of oil and gas experience, having served 28 years in various senior management roles with Range, including significant experience with mergers and acquisitions, land and risk management, midstream logistics and commodity sales.

To elect a nominee for director, a majority of the votes cast on Proposal No. 1 with respect to such nominee must vote “FOR” such nominee.

BOARD RECOMMENDATION

The Board of Directors Recommends Stockholders Vote “FOR” each of the Director Nominees Named in this Proxy Statement.

Directors Continuing in Office

Below is information about our continuing directors whose terms of office do not expire at the Annual Meeting. These individuals are not standing for re-election at this time:

Directors Whose Terms End at the 2024 Annual Meeting

Lee M. Canaan, 66,67, is the founder and portfolio manager of Braeburn Capital Partners, LLC (a private investment management firm), established in 2003 in Bloomfield Hills, MI. Ms. Canaan has over 35 years of oil and gas and investment management experience, starting her career as an Exploration Geophysicist at Amoco Production Company, then ARCO, and AIM/Invesco. She was elected to the Board in 2015.

Ms. Canaan currently serves on the board of EQT Corporation (natural(a natural gas production company operating exclusively in the Appalachian Basin of the U.S.), ROC Energy Acquisition Corporation (a special purpose acquisition corporation looking to acquire non-operated exploration and production working interest properties) and Aethon Energy, LLC (private(a private exploration and production company with main operations in East Texas and western Louisiana). She has also served on the board of directors of the following publicly held companies: Noble International Ltd. (a supplier to the automotive industry), from 2000 to 2004, where she served as the Compensation Committee Chairman from 2002 to 2004; Oakmont Acquisition Corporation (a special purpose acquisition corporation), from 2005 to 2007; Equal Energy Ltd. (oil(an oil and gas exploration and production)production company), from 2013 until its sale in 2014; and Rock Creek Pharmaceuticals (pharmaceutical(a pharmaceutical research and development)development company), from 2014 to 2016,

(10)

where she also served as the chairman of the Audit and Nominating and Corporate Governance committees. She also served on the board of Philadelphia Energy Solutions, LLC(aLLC (a private downstream energy company and the largest crude oil refining complex on the East Coast of the U.S.), from 2018 to 2020. She holds a bachelor’s degree in Geological Sciences from the University of Southern California, a master’s degree in Geophysics from the University of Texas at Austin, and an MBA degree in Finance from The Wharton School of the University of Pennsylvania. She is also a Chartered Financial Analyst.

Ms. Canaan’s qualifications to serve on the Board include her corporate finance, capital markets and merger and acquisition experience; her scientific background in geology and geophysics; her oil and gas exploration knowledge of North American basins; and her experience serving as a director of several public and private companies.

Peter B. Delaney, 69, is currently a principal with Tequesta Capital Partners, an entity that provides funding for various real estate and other ventures. He has held this position since 2016. Mr. Delaney was previously the Chairman and Chief Executive Officer of OGE Energy Corporation (“OGE Energy”) from 2007 to 2015. OGE Energy is a NYSE listed company and the parent company of OG&E, an electric utility provider, and owned a 50% interest in the General Partner of Enable Midstream Partners (NYSE: ENBL). Mr. Delaney was elected President of OGE Energy and as a member of its Board in 2007. Mr. Delaney retired as Chief Executive Officer of OGE Energy in May 2015 to step in as the Interim Chief Executive Officer of Enable Midstream Partners, a position he held until December 2015. From 2002 to 2013, Mr. Delaney also served as Chief Executive Officer of Enogex, an OGE Energy subsidiary involved in natural gas midstream services, and one of the predecessor companies to Enable Midstream Partners.

During his tenure as Chief Executive Officer, OG&E received numerous industry awards, among them the 2012 Utility of the Year and the 2013 Edison Award, the industry’s highest honor. Mr. Delaney previously completed a 16-year investment banking career on Wall Street, specializing in corporate finance and in providing other advisory services to electric utilities and other energy companies. In addition to extensive capital markets experience, he provided advisory services in tender offer defenses and mergers and acquisitions.

Mr. Delaney was elected to the Company’s Board in 2018. He has also served on the Board of Directors of the following companies: OGE Energy (Chairman) from 2007 to 2015; Enable Midstream Partners (Chairman) from 2013 to 2017: the Federal Reserve Bank of Kansas City from 2012 to 2017; and the Oklahoma City Boathouse Foundation (US Olympic and Paralympic Training Site) (Chairman) from 2007 to 2018. He currently serves on the Board of Directors of Integris Health System (comprised of hospitals and health providers throughout Oklahoma) (Chairman) since 2009; and Cabot Oil and Gas for a 3-year period ending October 4, 2021 upon the closing of the merger with Cimarex Energy Co.

Mr. Delaney’s qualifications to serve on the Board include his extensive management experience in the energy industry, extensive investment banking experience, financial expertise and his record of service on the board of directors of public and non-public companies. His management experience in the natural gas midstream sector provides him with a sound knowledge base and perspective on issues affecting the energy business.

Glen A. Brown, 66,67, has broad oil and gas experience both as a senior executive and as an independent explorationist. Mr. Brown served as the Senior Vice President of Exploration for Continental Resources (“Continental”) from 2015 to 2017. He joined Continental in 2012 as Manager of New Ventures and in 2013 was named Vice President of Geology. During his career at Continental, he managed annual budgets of $2 to $4 billion with active leasing, drilling and completion programs. Prior to joining Continental, he was an independent owner of NE LLC from 2003 to 2012, which developed projects that resulted in over 200 wells being drilled and completed with 12 different operators. From 1991 to 2003, he served as an Exploration Manager for EOG Resources-Midcontinent Division where he was responsible for various drilling programs and numerous field discoveries. From 1985 to 1991, Mr. Brown held middle management positions with TXO Production Company. From 1982 to 1985, he began his career as an Exploration Geologist with Marshall R. Young oil company. He holds a bachelor’s degree in Geology from State University of New York at Plattsburgh and a master’s degree in Geology from New Mexico State University in Las Cruces. Mr. Brown was elected to the Board in 2021.

(11)

Mr. Brown’s qualifications to serve on the Board include his 4042 years of oil and gas experience identifying acquisition and divestiture targets and assessing risks of projects, his extensive knowledge of prospect economics and of horizontal drilling and completions in unconventional resource plays, and his 33 years in various management roles.

To elect a nominee for director, a majority of the votes cast on Proposal No. 1 with respect to such nominee must vote “FOR” such nominee.

BOARD RECOMMENDATION

(10)

The Board of Directors Recommends Stockholders Vote “FOR” each of the Director Nominees Named in this Proxy Statement.

Directors Continuing in Office

Below is information about our continuing directors whose terms of office do not expire at the Annual Meeting. These individuals are not standing for re-election at this time:

Directors Whose Terms End at the 2025 Annual Meeting

Mark T. Behrman, 60,61, has been with LSB Industries, Inc. (“LSB”), Oklahoma City, (a publicly traded manufacturer and marketer of chemical products for the agricultural, mining and industrial markets) since 2014. Mr. Behrman currently serves as LSB’s President and Chief Executive Officer, a position he has held since December 30, 2018. Mr. Behrman joined LSB as Senior Vice President of Corporate Development and served in that capacity until June 2015 and served as Executive Vice President – Chief Financial Officer from June 2015 through December 2018. Prior to LSB, Mr. Behrman was Managing Director, Head of Investment Banking and Head of the Industrial and Energy Practices of Sterne Agee, Inc., from 2007 to 2014. Mr. Behrman has over 35 years of operational, financial, executive management, and investment banking experience.

Mr. Behrman has served on the Board since 2017, as its Chairman since 2019 and as Audit Committee Chairman from 2018 to 2022. He also has served on the Board of Directors of LSB since 2018 and on the Board of Directors of The Fertilizer Institute since 2019. Mr. Behrman previously has served on the board of directors of the following publicly held companies: Noble International Ltd., (a supplier to the automotive industry) from 1998 to 2007, where he also served as Audit Committee Chairman from 1998 to 2003; Oakmont Acquisition Corporation (a special purpose acquisition corporation), from 2005 to 2007 and;2007; and Robocom Systems International (a developer and marketer of advanced warehouse management software solutions), from 1998 to 2000.

Mr. Behrman holds an MBA in Finance from Hofstra University and a Bachelor of Science in Accounting, Minor in Finance from Binghamton University.

Mr. Behrman’s qualifications to serve on the Board include his executive management and operational experience, his extensive investment banking experience, his experience in accounting and finance, including as Chief Financial Officer of LSB Industries, his co-founding and management of several diverse businesses and his previous experience as a director of several public companies.

John H. Pinkerton, 68,70, has served on the Board since February 1, 2021. Mr. Pinkerton has had a long and distinguished career in the oil and gas industry, including serving at Range Resources Corporation (NYSE: RRC), a petroleum and natural gas exploration and production company, as President in 1990 and as Chief Executive Officer from 1992 until 2012. During his 27-year tenure, Range Resources grew from its small cap origins to be a $13 billion enterprise with a preeminent position in the Marcellus Shale. As CEO of Range Resources, Mr. Pinkerton established the technical expertise to enable a drilling-led strategy complemented by bolt-on acquisitions where synergies would enhance growth. Prior to joining Range Resources, Mr. Pinkerton served in various capacities at Snyder Oil Corporation for 12 years, including the position of Senior Vice President.

Mr. Pinkerton began serving as a director of Range Resources in 1988 and was Chairman of its board of directors from 2008 until his retirement as a director in January 2015. Since 2017, Mr. Pinkerton has served as Executive Chairman and is Chairman of the Board of Directors of Encino Energy, LLC, a Houston-based private oil and gas company. Mr. Pinkerton is also a director of EP Energy Corporation where he has served since October 2020. Mr. Pinkerton received his Bachelor of Arts degree in Business Administration from Texas Christian University, where he now serves on the board of trustees, and a Master’s degree from the University of Texas at Arlington. He has represented the energy industry in policy matters, serving on the executive committee of America’s Natural Gas Alliance.

Mr. Pinkerton’s qualifications to serve on the Board include his widespread skills in the management, acquisition and divestiture of oil and gas properties, including related corporate financing activities, hedging, risk analysis and the evaluation of drilling programs.

(12)(11)

Directors Whose Terms End at the 2026 Annual Meeting

Steven L. Packebush, 59, is a founder and partner in Elevar Partners, LLC, a company providing advisory services and capital solutions for companies in the agriculture and energy markets. Prior to Elevar Partners, Mr. Packebush worked at Koch Industries, Inc. for over 30 years, retiring in March 2018. Until his retirement, he was the president of Koch Ag & Energy Solutions (“KAES”). Under his leadership, KAES grew to be one of world’s largest fertilizer companies. Mr. Packebush also oversaw the expansion of KAES, which included the addition of three start-up businesses: Koch Energy Services became one of the largest natural gas marketing companies in North America; Koch Methanol supplied methanol to global customers in the plywood, carpet, fuels, and plastics markets; and Koch Agronomic Services became a global leader in enhanced-efficiency fertilizer production and marketing. Mr. Packebush currently serves on the LSB Industries, Inc. board of directors. He is a graduate of Kansas State University with a bachelor’s degree in agricultural economics. Mr. Packebush was appointed to the Board effective April 2022.

Mr. Packebush’s qualifications to serve on the Board include his extensive management and operational experience, and his management of a natural gas marketing company, which provided him with a broad knowledge of the energy market.

Chad L. Stephens, 68, was appointed Chief Executive Officer of the Company on January 16, 2020. Prior to his appointment as Chief Executive Officer, Mr. Stephens served as the Interim Chief Executive Officer of the Company, a position to which he was appointed in August 2019. Mr. Stephens previously served as Senior Vice President – Corporate Development of Range Resources Corporation (“Range”), a position he held from 2002 until his retirement effective December 31, 2018. Mr. Stephens joined Range in 1990 as Senior Vice President – Southwest. While at Range, he was responsible for the origination, valuation and acquisition or divestiture of over $6.0 billion of oil and gas producing properties. Mr. Stephens served on Range’s internal hedging committee and was responsible for the oversight of all gas, oil and NGL marketing and sales. Mr. Stephens holds a Bachelor of Arts degree in Finance and Land Management from the University of Texas. He was appointed to the Board in 2017 and previously served as its Lead Independent Director.

Mr. Stephens’ qualifications to serve on the Board include his 40 years of oil and gas experience, having served 29 years in various senior management roles with Range, including significant experience with mergers and acquisitions, land and risk management, midstream logistics and commodity sales.

CORPORATE GOVERNANCE AND OUR BOARD

Our Board

Board Leadership Structure and Non-Executive Chairman of the Board

The Company established the position of Non-Executive Chairman of the Board effective August 3, 2021, which replaced the role of Lead Independent Director. It is the policy of the Company that a Non-Executive Chairman of the Board shall be elected annually to preside over meetings of the Board and executive sessions of the Company’s independent directors, to facilitate information flow and communication between the directors and the Chief Executive Officer and to perform such other duties specified by the Board and outlined in the Charter of the Non-Executive Chairman of the Board.Board Guidelines. The Non-Executive Chairman of the Board determines the agenda and presides atover all Board meetings and all executive sessions of non-employee directors. The Non-Executive Chairman of the Board also performs other duties that the Board may from time-to-time delegate to assist the Board in the fulfillment of its responsibilities.

Effective August 26, 2019, Mark T. Behrman was named Lead Independent Director by the Board and was reaffirmed as the Non-Executive Chairman of the Board at the December 8, 2022March 4, 2024 Governance and Sustainability Committee meeting.

The Board adopted a “Non-Executive Chairman of the Board Guidelines,” which can be viewed at the Company’s website: www.phxmin.com under the “Governance Library” section of the “Corporate Governance” tab.

(12)

Board Independence

Our Board annually determines the independence of each director and nominee for election as a director based on a review of the information provided by the directors and nominees. The Board makes these determinations under the independence standards set forth in the NYSE Listed Company Manual, applicable SEC rules and our Corporate Governance Guidelines. A copy of our Corporate Governance Guidelines can be viewed at the Company’s website: www.phxmin.com under the “Governance Library” section of the “Corporate Governance” tab.

As a result of its annual evaluation, the Board affirmatively determined by resolution that each of the Company’s current non-employee directors is independent under the listing standards of the NYSE, the requirements of the SEC and our Corporate Governance Guidelines. The Board has determined that each of the following non-employee directors is independent and has no material relationship with the Company that could impair such director’s independence: Mark T. Behrman, Glen A. Brown, Lee M. Canaan, Peter B. Delaney (not standing for re-election), Steven L. Packebush, and John H. Pinkerton.

Chad L. Stephens is not independent based on his service as the Company’s President and Chief Executive Officer. Mr. Stephens is the only director who is an officer or employee of the Company, and he does not currently serve on any Board committee.

Meetings and Committees of the Board of Directors

During the fiscal year ended September 30, 2022 (“fiscal 2022”),December 31, 2023, the Board held 1319 meetings. At each meeting, a quorum of directors was present. The non-employee directors held executive sessions at each regularly scheduled Board meeting without management present.

Pursuant to the Corporate Governance Guidelines, the Company expects all of its directors to attend regularly scheduled Board and committee meetings and the annual meeting of stockholders. During fiscal 2022,2023, each director attended at least 75% of the meetings of the Board and each of the Board committees on which he or she served. All of the directors attended the Company’s 20222023 annual meeting.

Each year, the Board conducts a formal evaluation of its performance. Additionally, each Board committee conducts a formal evaluation of such committee’s performance. The Board and Board committee evaluations address, among other matters, the qualifications and performance of individual directors, overall Board or committee dynamics, the quality of information received from management, the appropriateness of matters reviewed and the

(13)

quality of Board or committee deliberations. The results of these evaluations are discussed with the chairs of the relevant committees, the Non-Executive Chairman of the Board, or the full Board in executive session, as appropriate.

Board Committees

The independent members of the Board are elected to serve on various Board committees. The Board presently has three standing committees: the Audit Committee, the Compensation Committee, and the Governance and Sustainability Committee. Each committee operates under a charter that has been approved by the Board, and the chair of each committee reports to the Board on actions taken at each committee meeting.

Audit Committee

The Audit Committee is currently comprised of Mark T. Behrman, Glen A. Brown, Lee M. Canaan (Chair) and Steven L. Packebush. The Board has determined that each member of the Audit Committee during fiscal 20222023 met all applicable independence requirements during such member’s service on the committee and the financial literacy requirements of the SEC and the NYSE. Mark T. Behrman, Glen A. Brown, Lee M. Canaan and Steven L. Packebush have been determined by the Board to each meet the “audit committee financial expert” requirements of the SEC.

The purpose of the Audit Committee is to provide assistance to the Board in fulfilling its oversight responsibility to the Company’s stockholders, potential stockholders, the investment community and others, relating

(13)

to: the integrity of the Company’s financial statements; the financial reporting process; the systems of internal accounting and financial controls; the performance of the Company’s internal audit function and independent auditors; the independent auditors’ qualifications and independence; cybersecurity risk, and the Company’s compliance with ethics policies and legal and regulatory requirements. The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board and report the results of the Audit Committee’s activities to the Board. While the Audit Committee has the responsibilities and powers set forth in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company’s financial statements and for reviewing the Company’s unaudited interim financial statements. For additional information regarding the functions performed by the Audit Committee, see “Report of the Audit Committee.”

The Audit Committee met fivefour times during fiscal 2022.2023. The Audit Committee Charter, as amended in December 2017,September 2023, is available at the Company’s website: www.phxmin.com under the “Governance Library” section of the “Corporate Governance” tab.

Compensation Committee

The Compensation Committee is currently comprised of Mark T. Behrman, Glen A. Brown (Chair), Peter B. Delaney (Chair)(not standing for re-election), and John H. Pinkerton. Messrs. Behrman, Brown, Delaney, and Pinkerton served on the Compensation Committee during fiscal 2022. Mr. Behrman joined the Compensation Committee effective April 1, 2022.2023. During fiscal 2022,2023, each member of the Compensation Committee met the applicable independence requirements during his service on the Compensation Committee, including the enhanced independence standards of the NYSE, and qualifies as a “Non-Employee Director” under Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The purpose of the Compensation Committee is to discharge the Board’s responsibilities relating to compensation, employee benefits and incentive programs of the Company. The Compensation Committee has the overall responsibility of approving and evaluating executive officer compensation, retirement plans, policies and programs of the Company, and the compensation of directors. The Compensation Committee’s function includes reviewing officer performance and recommending to the Board compensation amounts for executive officers and directors. The Compensation Committee also oversees the administration of the Company’s 401(k) Plan. For

(14)

additional information regarding the Compensation Committee, please see the Compensation Committee Charter and the “Compensation Discussion and Analysis” section of this proxy statement.

The Compensation Committee met ninefive times during fiscal 2022.2023. The Compensation Committee Charter as amended in May 2022, is available at the Company’s website: www.phxmin.com under the “Governance Library” section of the “Corporate Governance” tab.

Governance and Sustainability Committee

The Corporate Governance and Nominating Committee was renamed the Governance and Sustainability Committee by the Board in December 2021. The Governance and Sustainability Committee is currently comprised of Lee M. Canaan, Peter B. Delaney (not standing for re-election), Steven L. Packebush, and John H. Pinkerton (chair). Ms. Canaan and Messrs. Delaney and Pinkerton served on the Governance and Sustainability Committee during all of 2023, and Mr. Packebush served on the entire fiscal 2022.Governance and Sustainability Committee since March of 2023. The Board determined that each member of the Governance and Sustainability Committee during fiscal 20222023 met the applicable independence requirements.

The purpose of the Governance and Sustainability Committee is to assist the Board with the management of its corporate governance, nominating and sustainability duties and responsibilities. Functions of the Governance and Sustainability Committee include: searching for, identifying and screening individuals qualified to become members of the Board; recommending to the Board when new members should be added to the Board; recommending to the Board individuals to fill vacant Board positions; recommending to the Board nominees for election as directors at each annual meeting; and recommending the committee structure of the Board and the directors who will serve as members and chairs of each committee. If a vacancy on the Board exists that will not be filled by an incumbent director, the Governance and Sustainability Committee identifies prospective nominees from

(14)

several sources, including through the Board’s and management’s business and industry contacts and through stockholder recommendations. Currently, the Company does not pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential nominees.

The Governance and Sustainability Committee is also responsible for overseeing and evaluating compliance by the Board and management with the Company’s corporate governance principles and its Code of Ethics and Business Practices. The Governance and Sustainability Committee reviews periodically the corporate governance policies and principles of the Company and oversees the creation and implementation of policies and procedures appropriate for the Company related to the environment, sustainable development, and corporate responsibility.

Diversity

Although the Governance and Sustainability Committee does not have a formal policy with respect to diversity when considering potential nominees for Board membership, the Governance and Sustainability Committee seeks individuals with backgrounds and qualities that, when combined with those of the Company’s existing directors, provide a blend of skills and experience that will further enhance the Board’s effectiveness at the time the consideration is made. When considering potential nominees for Board membership, the Governance and Sustainability Committee considers, among other things, the candidate’s character, wisdom, judgment, acumen, diversity, skills, financial literacy, experience and understanding of and involvement in the oil and gas industry. The committee also considers a potential nominee’s availability to devote the time and effort necessary to fulfill his or her responsibilities in the context of the needs of the Company and the Board. Our Bylaws generally provide that a person may not stand for election or re-election as a director after attaining the age of 75.75, provided that, in the sole discretion of the Board, a director who is over 75 years of age may be re-elected for one additional term of one year.

(15)

Stockholder Nominees

The Governance and Sustainability Committee will consider nominees proposed by stockholders of the Company if the requirements set forth in the Company’s Bylaws are satisfied. Nominations from our stockholders must include sufficient biographical information for the Governance and Sustainability Committee to appropriately assess the proposed nominee’s background and qualifications. To propose a prospective nominee for consideration by the Governance and Sustainability Committee, stockholders must submit the proposal in writing to PHX Minerals Inc., Attention: Secretary, 1320 S. University Dr., Suite 720, Fort Worth, Texas 76107. Any such submission must be accompanied by the proposed nominee’s written consent to being named as a nominee and to serve as a director, if elected. Whether recommended by a stockholder or through the activities of the Governance and Sustainability Committee, the Governance and Sustainability Committee seeks to select candidates who have distinguished records and who will make significant contributions to the Board and the Company. There are no differences in the manner in which the Governance and Sustainability Committee evaluates nominees for director based on whether a nominee was recommended by the incumbent directors or by a stockholder. For additional information, please see our Bylaws and the “Stockholder Proposals” section of this proxy statement.

The Governance and Sustainability Committee met fourtwo times during fiscal 2022.2023. The Governance and Sustainability Committee Charter as adopted in December 2021, and the Code of Ethics and Business Practices are available at the Company’s website: www.phxmin.com under the “Governance Library” section of the “Corporate Governance” tab.

Board Role in Risk Oversight

Management is responsible for day-to-day risk assessment and mitigation activities. The Board is responsible for risk oversight, focusing on the Company’s overall risk management strategy, its degree of tolerance for risk, and oversight of the steps management is taking to manage the Company’s risk. This process is designed to provide to the Board timely visibility needed for the identification, assessment and management of critical risks. The Audit Committee assists the Board by annually reviewing and discussing with management this process and its functionality. The areas of critical risk for the Company include information technology, strategic, operational, compliance, environmental and financial risks. The Board, or the Audit Committee, receives information regarding areas of risk and potential risk exposure through updates from the appropriate members of management to enable the Board to understand and monitor the Company’s risk management process. Information brought to the attention of the Audit Committee is appropriately shared with the Board.

(15)

The Board has oversight responsibility for our cybersecurity risk management program. Management is responsible for identifying, considering and assessing material cybersecurity risks on an ongoing basis, establishing processes to ensure that such potential cybersecurity risk exposures are monitored, putting in place appropriate mitigation measures and maintaining cybersecurity programs. Our cybersecurity programs are under the direction of our Principal Accounting Officer, who receives reports from our cybersecurity consultants and monitors the prevention, detection, mitigation, and remediation of cybersecurity incidents. Any significant cybersecurity incidents are reported to the Audit Committee and ultimately to the Board. There were no such cybersecurity incidents in 2023, the Transition Period, fiscal 2022, or fiscal 2021. Management presents an assessment of our cybersecurity processes, procedures, and results of testing to the Audit Committee at least annually.

Compensation of Directors

The compensation of our non-employee directors is reviewed by the Compensation Committee and is approved by the Board. We use a combination of cash and equity-based incentive compensation to attract and retain qualified candidates to serve on our Board. We consider the responsibilities of our non-employee directors and the amount of time such directors spend fulfilling their responsibilities and duties as a director in determining Board and Board committee compensation.

On December 9, 2022, the Company changed its fiscal year end from September 30 to December 31. Accordingly, the Company reported a transition period that ran from October 1, 2022 through December 31, 2022, which we refer to as the (“Transition Period” or “Tr.”). All references to years or fiscal years, unless otherwise noted, refer to the Company’s fiscal year ended December 31 with respect to 2023 and September 30 with respect to prior years. For example, references to 2023 mean the fiscal year ended December 31, 2023 and references to 2022 mean the fiscal year ended September 30, 2022.

The following summary includes information regarding the compensation earned by our non-employee directors during fiscal 20222023 and the Transition Period for service on our Board and Board committees.

Cash Annual Retainers

For fiscalcalendar 2022, each of our non-employee directors received an annual retainer of $45,000,$45,000. For the first three quarters of 2023, each of our non-employee directors received a retainer of $13,750 per quarter (which was based on an annual retainer of $55,000), which has been pro-rated forwas increased to $15,000 per quarter in the directors that served a partial year.fourth quarter (which was based on an annual retainer of $60,000). We also reimburse our non-employee directors for out-of-pocket travel expenses incurred in connection with attending Board and committee meetings. The Non-Executive Chairman of the Board received an additional annual retainer of $25,000 for each of calendar 2022 and 2023, and the chairs of the Audit Committee, the Compensation Committee, and the Governance and Sustainability Committee received additional annual retainers of $13,000, $10,500, and $9,000, respectively.respectively, for each of calendar 2022 and 2023. The annual retainers were paid in equal installments on December 31, 2021, and March 31, June 30, and September 30 and December 31 for each of calendar 2023 and calendar 2022. The first retainer installment subsequent to fiscalcalendar year 20222023 was paid on the same basis on DecemberMarch 31, 2022. We recently changed our fiscal year such that fiscal year 2023 and future fiscal years will end on December 31 rather than September 30.

(16)

2024.

The Company’s retainer and fee structure for non-employee directors was guided by a study conducted by Meridian Compensation Partners (“Meridian”), an independent compensation consultant.

Equity Incentive Plans for Non-Employee Directors

The Company’s Deferred Compensation Plan for Non-Employee Directors (the “Directors’ Deferred Compensation Plan”) and the PHX Minerals Inc. 2021 Long-Term Incentive Plan (the “LTIP”) serve as the equity incentive plans for the Company’s non-employee directors.

Deferred Compensation Plan for Non-Employee Directors

Annually, non-employee directors may elect to be included in the Directors’ Deferred Compensation Plan. The Directors’ Deferred Compensation Plan provides that each non-employee director may individually elect to be credited with future unissued shares of Common Stock rather than cash for all or a portion of the director’s annual retainers, and may elect to receive shares, if and when issued, over annual time periods up to ten years. These unissued shares of Common Stock are recorded to each director’s deferred compensation account at the closing

(16)

market price of the shares on the payment dates of the annual retainers. Dividends are credited to each deferred account on the record date of each declared dividend. Upon a director’s retirement, resignation, termination, death or a change-in-control of the Company, the unissued shares of Common Stock recorded for such director under the Directors’ Deferred Compensation Plan will be issued to the director. In the case of a change-in-control of the Company, all shares in the deferred accounts will be issued in a single lump sum to the appropriate directors at the closing of the event triggering such change-in-control. The promise to issue such shares in the future is an unsecured obligation of the Company. The following directors participated in the Directors’ Deferred Compensation Plan during all or a portion of fiscal 2022: Mark T. Behrman, Glen A. Brown, Peter B. Delaney, Steven L. Packebush, and John H. Pinkerton.

Long-Term Incentive Plan

The Company’s independent directors are eligible to participate in the Company’s LTIP.

On March 2,December 8, 2022, the BoardCompensation Committee approved issuingthe granting of restricted stock awards to each Directordirector in thean amount ofdetermined by dividing $60,000 divided by the Company’s closing share price as of the last trading day on or prior to December 31, 2021. 2022, and such awards were issued by the Board on April 20, 2023 after the stockholders approved an increase in the Company's authorized shares. On December 7, 2023, the Compensation Committee approved the granting of restricted stock awards to each director in an amount determined by dividing $60,000 by the Company’s average daily closing share price during the last five trading days ended December 18, 2023, and such awards were issued by the Board on December 21, 2023.

The shares were grantedissued on April 20, 2023 either vested in March 2022 underDecember 2023 or, if elected by the Company’s LTIPdirector, will vest upon retirement or annually in equal installments up to five years after the director’s retirement, and vestedthe shares issued on December 21, 2023 will vest in December 2024 or, if elected by the director, will vest upon retirement or annually in equal installments up to five years after the director’s retirement. The restricted stock awards issued on April 20, 2022.2023 were for the 2023 award year, and the restricted stock awards issued on December 21, 2023 are for the 2024 award year. On a go-forward basis, we expect to grant and issue restricted stock awards for any given year in December of the preceding year. For additional information regarding the grants of restricted stock to our non-employee directors, please see the “Non-Employee Directors Compensation”Compensation for 2023 and the Transition Period” table below.

Director Compensation for Fiscal 20222023 and the Transition Period